Business Interruption Insurance: Covering Weather Related Business Losses

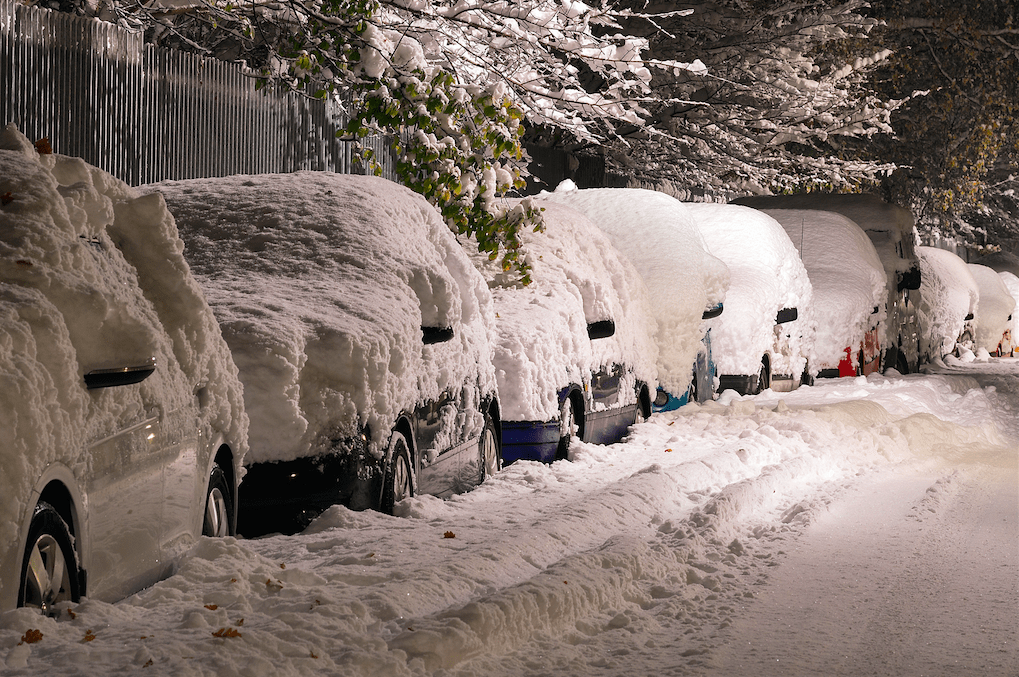

by Michelle Bomberger | February 11, 2019The Seattle area is experiencing unusual amounts of snow which has caused businesses to lose money. They either can’t open their doors to serve clients because employees are unable to get to work, or a loss of power, or their clients have canceled events, appointments or projects. In each of these cases, the businesses have lost real revenue – and with the coming week bringing more snow, the amounts at stake are increasing. Does a business have any recourse?

How Business Interruption Insurance Can Help

Business interruption insurance is designed to help businesses with lost revenue due to certain events. Many general liability policies include some coverage for lost revenue due to business interruption, but the coverage is often a small amount and the events covered may be narrowly defined. Depending on the nature of your business, you may wish to acquire a separate policy that addresses the specific and likely events to occur and damages that your business will sustain.

Business Interruption policies typically cover the revenue or profits you would have earned during the period of closure; operating expenses including employee wages, taxes, loans, and rent; and relocation expenses for temporary space. For example, a restaurant may lose power and be unable to open to the public. In addition to lost revenues, the restaurant will sustain losses related to lack of refrigeration and spoilage. Similarly, a janitorial company may not be able to travel to client locations to provide services. The policy typically kicks a few days after the triggering event (typically 72 hours) and provides coverage for the duration of the closure; but the specifics coverage details are specific to your policy. The amount you receive from your insurance company will be based on your company’s financial records. You’ll need to provide proof of your damages which usually includes average income and your regular expenses to demonstrate the amount of damage you have sustained; but, again, each policy provides unique requirements.

Additional Considerations for Business Owners

In addition to your insurance coverage, your contracts with customers may address “force majeure” which says you’re not liable for non-performance if an event outside of your control occurs. You may also seek non-refundable deposits, which can provide you with some protection against these risks as well.

Remember that risk mitigation is a mix of tools, and it’s important you know what the risks are and what tools you have to protect against them. If your business is at risk of closure or losses due to weather-related events, make sure you confirm your contracts give you some flexibility in performance and your insurance provides adequate business interruption coverage to keep your business going in the case of unexpected events.